Published On Apr 18, 2023

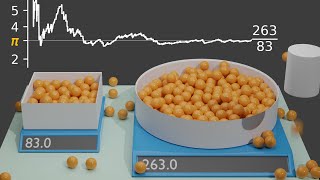

In this video I show a method I use to exit trades for momentum/trend following strategies. It is the Hawkes Process, a useful tool for algorithmic traders to know. The Hawkes Process is a type of self-exciting process and can be used to handle the self-exciting behavior found in volume/volatility. In this video we apply it to measure of volatility, the range of candles (high - low). Often major trends exhibit higher volatility. Trends often end around the same time that the volatility has dispersed. I show a simple trading strategy using the hawkes process that has decent performance and fairly high win rates for a momentum based trading strategy. A python implementation is shown for the indicator and the strategy.

Patreon: / neurotrader

Code: https://github.com/neurotrader888/Vol...

Links

https://en.wikipedia.org/wiki/Point_p...

https://en.wikipedia.org/wiki/Hawkes_...

https://en.wikipedia.org/wiki/Volatil...

https://github.com/tr8dr/tseries-patt...

https://tr8dr.github.io/BuySellImbala...

https://tr8dr.github.io/

The content covered on this channel is NOT to be considered as any financial or investment advice. Past results are not necessarily indicative of future results. This content is purely for education/entertainment.