Published On Jan 25, 2024

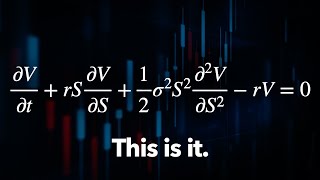

Learn about Random Walks and Volatility, and why the Efficient Market Hypothesis is hated by technical analysts who actively trade stocks, because it implies that you can't beat the market. In this video, we are going to show why random walks fail to capture the true nature of stock and other financial markets, due to what is known as volatility clustering (clustered volatility).

Some economists imagine a world where stock markets follow an unpredictable path, where no one can tell if the market is going to go up or down. This is a random walk, and it’s the basis for the Efficient Market hypothesis. It was supposed to make pricing of financial instruments, such as stock options, much more accurate. But as we'll discover, real markets have hidden complexity which can’t be captured by such a simple analysis.

In today's video, we're diving into why the traditional random walk model falls short in capturing how financial markets really work, and introducing some advanced financial mathematics.

Here we're going to examine what a random walk is, and why you might want to use it for financial modelling. And we’re going to discuss a topic of great importance to understand stock market behavior – volatility clustering. But we’re also going to address the Elephant in the room – why do so many traders hate random walk models? And ultimately, why the Random Walk model fails.

Coin image:

Image by Clker-Free-Vector-Images from Pixabay