Published On Jun 26, 2024

Key Takeaways

MultiChoice Trading Opportunity: Potential for profit if the Canal+ deal goes through, despite current low stock prices.

Futures Trading: Importance of understanding margin, liquidity, and strategy when trading ALSI and ALMI futures.

Market Conditions: Current cheap valuation of SA Inc stocks presents opportunities, pending political stability and cabinet announcements.

MultiChoice Mis-pricing: 00:27

Discussion on the 125 Rand mandatory offer from Canal+ for MultiChoice.

Current stock trading at 102 Rand due to poor financial results.

Analysis of Canal+'s offer document, potential deal completion, and possible trading opportunities.

Index Futures - ALSI and ALMI: 04:00

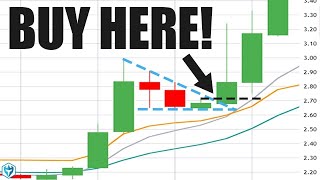

Detailed overview of trading ALSI (All Share Index) and ALMI (All Share Index Mini) futures.

Explanation of points trading, margin requirements, and contract specifics.

Tips on trading strategies, including liquidity considerations and handling overnight gaps.

Trading as a side hustle, watch the video.

Market and Stock Updates: 17:54

Cabinet Announcement Awaited: Market reactions and fluctuations in the Rand.

Individual Stocks: Analysis of Mr. Price*, Foschini Group*, Nedbank, Spur, and CMH*.

Banking Sector: Observations on price to book ratios and the overall market valuation of SA Inc stocks.

Simon Brown