Published On Dec 26, 2023

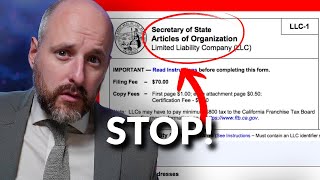

In this video, we're going to talk about why you should definitely not start an LLC until you do this first. By following these simple steps, you'll avoid many common LLC problems and set yourself up for success in business.

If you're thinking about starting an LLC, be sure to watch this video first! By following these steps, you'll avoid common problems and set yourself up for success.

You can schedule a FREE discovery call with our team with the link below.

https://www.jamesbakercpa.com/schedule

Or get your questions answered right away on a call with James. Schedule with the link below to receive clarity on your tax situation and stop spinning wheels.

https://www.calendly.com/jamesbakercp...

Would you like to learn our 3 step strategy for owning and operating a US Company? Do you want to grow your business and pay no taxes without spending hours and hours learning how everything works on youtube?

You can schedule a FREE discovery call with our team with the link below.

https://www.jamesbakercpa.com/schedule

**********

Check out James’ top recommended videos here - these are cornerstone videos that should answer many of your questions.

-----Longer videos that explain it all!

How to Legally Pay NO US Taxes - • IRS Secrets: How to LEGALLY to Pay NO...

How to Legally Pay NO US Taxes (part 2) - • Are you a Non Resident In The US? Inc...

-----Guides and How tos

Annual reporting for a foreign owned multi member LLC (Masterguide) - • Tax Laws for Foreign-Owned Multi-Memb...

What is Form W-BEN and why do I need it • How to Fill Out W-8BEN Form Correctly...

Which payments from US Companies are subject to withholding? • Which US Payments are Subject to Non-...

How to complete Form W-8BEN - • 🧾🔍 HOW TO complete Form W-8BEN-E for...

How to complete Form W-8BEN-E - • How to Complete Form W-8BEN-E in 2020...

How to get an ITIN - • Get A ITIN Number - W-7 Form (Step By...

-----And don’t forget to check out all of the “CALLS WITH JIM”

• Calls with Jim

**********

Do you want to learn how to open and operate a Tax Free Company in the USA even if you live outside the US and don’t have a visa.

Click here - https://www.jamesbakercpa.com/offers/...

Already have an LLC? Did you already complete form 5472 for your company? Did you know there is a $25,000 penalty for not doing this form? I’ve made a short training that explains exactly what you need to do and why so you can get this done quickly and correctly, the first time around.

Click here - https://www.jamesbakercpa.com/offers/...

**********

Looking for help with your SALES TAXES? Check out a couple of our videos on the topic -

What are sales taxes? • Do I pay Sales Taxes or Income Taxes?

What is a resale Certificate and Why do you Need it - • What is a Resale Certificate and Why ...

How to get a Florida Resale Certificate, Part 1 - • 📝💼How to get FLORIDA RESALE TAX CERTI...

How to get a Florida Resale Certificate, Part 2 - • Get Your Florida Resale Certificate N...

How to file a DR-15 Florida Sales and Use Tax with 0 Sales - • Florida Sales Tax Filing for Beginners

I get asked what company I recommend to help with sales taxes and every time I mention Tax Jar. Once set up, tax jar can complete all of your monthly sales tax filings automatically. If you are looking to solve this problem forever, click this link to find out more about what they can do for you. https://taxjar.grsm.io/jamesbaker7628

**********

WEB ➤ https://www.jamesbakercpa.com

YOUTUBE (EN ESPANOL) ➤ / tuempresaenamerica

FACEBOOK ➤ / jamesbakercpa

LINKEDIN ➤ / jimbakercpa

INSTAGRAM ➤ / jamesbakercpa

TIKTOK ➤ / jamesbakercpa

¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡

Lawyer Disclaimer (Occupational Hazard): This is not legal advice. Everything here is for informational purposes only and not for the purpose of providing legal advice. You should contact your attorney for advice regarding any particular issue or problem.