Published On May 28, 2024

🟢 TRADE IDEAS & DISCORD: / figuringoutmoney

🟢 Trade With The Best: http://bit.ly/3mIUUfC

In today's episode, we dive into the crucial question: "Does this yield curve inversion even matter anymore?" Join me as we unpack the implications of a potential yield curve uninversion and its impact on the S&P 500, which has been stuck in a narrow trading range.

We’ll break down:

- The recent comments from Fed's Kashkari about interest rate hikes and the market's reaction.

- The CME Fedwatch tool's insights on future rate changes.

- How the ECB's stance on rate cuts contrasts with the Fed's position.

- The effect of the 10-year Treasury yield rising above 4.5% and its implications for energy stocks and other sectors.

I also analyze the correlation between the 10-year yield and the S&P 500, showing you detailed charts and patterns. We'll discuss the importance of energy sector performance in relation to rising yields and highlight top energy stocks worth watching.

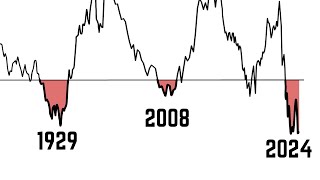

Additionally, we explore the longest yield curve inversion since the 1980s and its historical significance, especially when the curve starts to uninvert. I provide a detailed analysis of current market conditions, key gamma levels, and the potential moves in the S&P 500.

__________________________________________________________________________________________

🔔 Subscribe now and never miss an update: https://www.youtube.com/c/figuringout...

📧 For business inquiries or collaboration opportunities, please contact us at [email protected]

📈 Follow us on social media for more insights and updates:

🟢 Instagram: / figuringoutmoney

🟢 Twitter: / mikepsilva

______________________________________________________________________________________________

DISCLAIMER: I am not a professional investment advisor, nor do I claim to be. All my videos are for entertainment and educational purposes only. This is not trading advice. I am wrong all the time. Everything you watch on my channel is my opinion. Links included in this description might be affiliate links. If you purchase a product or service with the links that I provide I may receive a small commission. There is no additional charge to you! Thank you for supporting my channel :)

Interactive Brokers provides execution and clearing services to its customers. Influencer is not affiliated with, recommended by or an agent of Interactive Brokers. Interactive Brokers makes no representation and assumes no liability to the accuracy or completeness of the information

provided in this video. For more information regarding Interactive Brokers, please visit www.interactivebrokers.com. None of the information contained herein constitutes a recommendation, offer, or solicitation of

an offer by Interactive Brokers to buy, sell or hold any security, financial product or instrument or to engage in any specific investment strategy. Investment involves risks. Investors should obtain their own independent financial advice and understand the risks associated with investment

products/ services before making investment decisions. Risk disclosure statements can be found on the Interactive Brokers website. Influencer is a customer of Interactive Brokers. Interactive Brokers and Influencer have entered into a cost-per-click agreement under which Interactive pays Influencer a fee for each click-through of the Interactive Brokers URL posted herein.

#Stockmarket #StockMarketAnalysis #DayTrading