Published On May 2, 2024

🟢 TRADE IDEAS & DISCORD: / figuringoutmoney

🟢 GREAT BROKERAGE ACCOUNT: http://bit.ly/3mIUUfC

🟢 BOOKMAP DISCOUNT (PROMO CODE "BM20" for 20% off the monthly plans): https://bookmap.com/members/aff/go/fi...

🟢 TODAY'S CHART DECK: https://www.slideshare.net/slideshow/...

__________________________________________________________________________________________

📈 *Welcome to today's Stock Market Brief* with Michael Silva. If you've missed the latest earnings reports, you've missed hearing a common theme echoed across boardrooms: consumers are feeling the squeeze. Let's dive into what this means for the stock market and how it might influence our investment strategies.

🔍 In this episode, we explore significant shifts in the market. Following a relentless rally, we're now seeing some volatility. I'll break down the latest in relative rotation charts, showcasing sectors like utilities and consumer staples that are gaining strength, hinting at potential economic cooling. What does this mean at a time when energy traditionally signals market tops? Let's decode the signs.

📊 Today, I will also discuss:

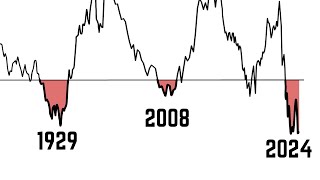

- The implications of a shifting economic cycle potentially indicating an early recession.

- A detailed analysis of the expansion and contraction stages in the business cycle and what it tells us about the bonds, stocks, and commodities markets.

- How current interest rates and inflation are putting pressure on consumers and impacting their financial decisions, with a particular focus on credit card debt and auto loans.

🚀 *Market Movements & Predictions:*

- We will analyze today's market movements, highlighting sectors that have shown significant activity and what that could mean going forward.

- Insights from technical indicators and patterns that suggest possible future movements in major indexes like the S&P 500 and NASDAQ.

📅 *Looking Ahead:*

- I will preview critical economic data set to release tomorrow, including non-farm payrolls and ISM services data, and discuss how these could sway the markets.

💡 *Stay Informed and Engaged:*

- For deeper dives and more detailed analysis, make sure to check out the links in the description for access to our swing trading community and our partners at Interactive Brokers.

👍 Don't forget to like, subscribe, and hit the notification bell to stay updated with the latest market insights. Join me as we navigate these challenging financial times with the sharp focus of technical and intermarket analysis.

______________________________________________________________________________________________

🔔 Subscribe now and never miss an update: https://www.youtube.com/c/figuringout...

📧 For business inquiries or collaboration opportunities, please contact us at [email protected]

📈 Follow us on social media for more insights and updates:

🟢 Instagram: / figuringoutmoney

🟢 Twitter: / mikepsilva

______________________________________________________________________________________________

DISCLAIMER: I am not a professional investment advisor, nor do I claim to be. All my videos are for entertainment and educational purposes only. This is not trading advice. I am wrong all the time. Everything you watch on my channel is my opinion. Links included in this description might be affiliate links. If you purchase a product or service with the links that I provide I may receive a small commission. There is no additional charge to you! Thank you for supporting my channel :)

Interactive Brokers provides execution and clearing services to its customers. Influencer is not affiliated with, recommended by or an agent of Interactive Brokers. Interactive Brokers makes no representation and assumes no liability to the accuracy or completeness of the information

provided in this video. For more information regarding Interactive Brokers, please visit www.interactivebrokers.com. None of the information contained herein constitutes a recommendation, offer, or solicitation of

an offer by Interactive Brokers to buy, sell or hold any security, financial product or instrument or to engage in any specific investment strategy. Investment involves risks. Investors should obtain their own independent financial advice and understand the risks associated with investment

products/ services before making investment decisions. Risk disclosure statements can be found on the Interactive Brokers website. Influencer is a customer of Interactive Brokers. Interactive Brokers and Influencer have entered into a cost-per-click agreement under which Interactive pays Influencer a fee for each click-through of the Interactive Brokers URL posted herein.

#Stockmarket #StockMarketAnalysis #DayTrading