Published On Feb 17, 2024

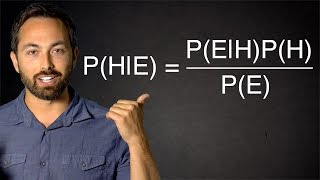

In this quick TA session, we return to the art of formulizing the Bellman equation. Recall that mastering this art, referred to as the imperative ‘Bellmanize!’, is one of the basic creeds of the Chicago School of Economics—this is the reason why we are also trying to learn as much as we can about this art. Today we deal with an information problem. A political dynasty is supposed to optimize in terms of stocks of political capital in two districts, where political capitals evolve according to laws of motion. To optimize, the dynasty must find an optimal allocation of time between the two districts—the more time they spend in one district, the higher the capital gain there, but the higher the sacrifice in terms of political capital of the other district. To complicate things, there is a shock that affects the outcomes of the allocative decisions. In the simplest case, the dynasty can observe the shock, it thus makes an informed decision. However, in more complicated cases it only observes a signal on the basis of which it calculates an expected value of the shock—so in the Bellman equation the maximand is an expected expression. Most interestingly, we also deal with cases where we write the Bellman equation at a time when the shock is unobserved while we know that the dynasty is going to have this piece of information, i.e. it is going to be over the moment when the shock becomes known, when making the decision.

Title page:(00:00)

The problem:(00:10)

Case 1:(03:06)

Case 2:(07:40)

Case 3:(10:50)

Case 4:(14:09)

Case 5:(18:50)