Published On May 6, 2019

Speakers:

- Thorsten Koeppl (Professor, Queen’s University)

- Agnieszka Smoleńska (Polityka Insight and European University Institute)

Recording of the online seminar on 30 April 2019.

More information: http://fbf.eui.eu/event/online-semina...

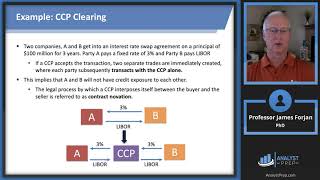

Over the past decade, clearinghouses have subsumed the management of counterparty risk for many financial transactions. Regulators and supervisors thus face a new nexus for risk in financial markets, where these institutions have become too important too fail.

The European Union set out a comprehensive regulatory framework for Central Counterparties (CCPs) in recent years, in order to improve their ability to face possible financial distress. Reforms adopted in the last months aim to ensure a more consistent and robust supervision of CCPs in EU and non-EU countries to tackle emerging challenges.

In this context, the online seminar offers a primer on the features of CCPs as both insurers and sources of systemic risk.

* The views and opinions expressed in this video are those of the speakers or authors in their personal capacity and do not necessarily reflect the official position of the Robert Schuman Centre or the European University Institute. *